As the stimulus package wends its way through Congress the arguments in support of even the basic principle are becoming increasingly half-hearted. Brad Setser has compared the current recession with other post 1945 downturns and come to the conclusion that it is really, really bad. He thus endorses a large stimulus:

“That is why — despite the risks — I support a large stimulus. The United States debt levels suggest that it still has room to use the public sector’s balance sheet to try smooth the economic cycle. And there is nothing moderate about the current cycle.”

‘Things are really bad, we should try something, even if its very risky’, isn’t exactly a ringing endorsement of fiscal stimulus as a response to the current crisis. In fact, it reveals the biggest problem with fiscal stimulus. While the costs are large and certain, the supposed benefits aren’t exactly guaranteed.

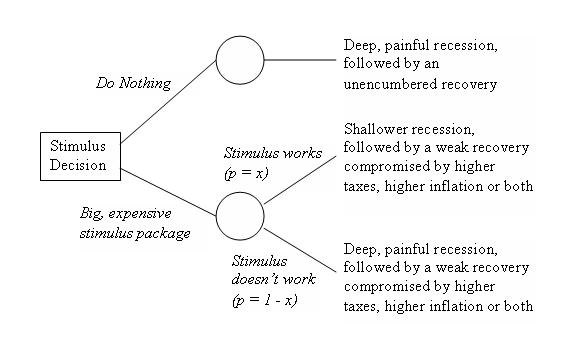

In situations like this it is often helpful to lay out the options and their consequences in the form of a decision tree:

In this case X is certainly less than one. It may in fact be significantly less than one.

At the very least, this should give us pause before endorsing stimulus as a policy response. It is always worth remembering that there is no situation so bad that Congress can’t make it worse.

Leave a Reply