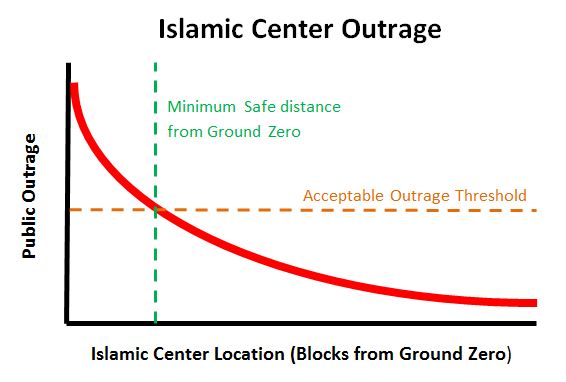

I’m curious about how far an Islamic center needs to be from Ground Zero before the terrorists stop winning.

(Paraphrased from the comments on this blog post)

“I hope there’s a money tree somewhere to pay for all of this.”

“There used to be a money tree, but the magic pony ate it.”

“Don’t worry about the magic pony. It may eat money trees, but it craps pure un-rationed efficient high-quality government health care for every American.”

This is from a fascinating article on the impact the taxman has had on boxing:

The 1950s was the era of the 90 percent top marginal tax rate, and by the end of that decade live gate receipts for top championship fights were supplemented by the proceeds from closed circuit telecasts to movie theaters. A second fight in one tax year would yield very little additional income, hardly worth the risk of losing the title. And so, the three fights between Floyd Patterson and Ingemar Johansson stretched over three years (1959-1961); the two between Patterson and Sonny Liston over two years (1962-1963), as was also true for the two bouts between Liston and Cassius Clay (Muhammad Ali) (1964-1965). Then, the Tax Reform Act of 1964 cut the top marginal tax rate to 70 percent effective in 1965. The result: two heavyweight title fights in 1965, and five in 1966. You can look it up.

The lesson can be summed up in two words – INCENTIVES MATTER

Now that health reform (at least in its current form) is more or less dead, it is time to ask who is more relieved:

- The consumers and taxpayers saved from a disastrous attempt at reform

- The Democratic caucus which has been saved from having to pass it’s own disastrous attempt at reform

Scott Brown may just have saved a lot of Democratic political careers.

Some things just lend themselves to smart ass responses:

- New York Jets fans are demanding that Mark Sanchez be immediately inducted into the hall of fame. Sure he hasn’t really done anything yet, but he takes a nice picture and seems to be much less of a jerk than the last guy.

- Apparently Angela Merkel was also considered as short listed for the Nobel Peace Prize. The fact that she has only bought one bankrupt car company probably counted against her.

Megan McCardle has pointed out that the ‘successful’ cash for clunkers program has resulted in a rather nasty hangover for automakers. Her argument is that:

Cash for Clunkers moved a bunch of auto sales forward, causing people who thought they might replace their car in the next year or two to rush into the showrooms.

This is a true but incomplete explanation. The Cash for Clunkers sales likely came from several sources:

- Once the program was announced many buyers likely postponed purchases until they could take advantage of the subsidy. So sales in the period immediately prior to the start of the program were artificially lowered.

- As Megan points out, people who intended to buy a car in the next year or so likely brought forward their purchase in order to take advantage of the subsidy. So sales in the period after the end of the program were (and will continue to be) artificially low.

- People who were weighing up possible purchases opted to buy a car, as opposed to say new appliances or a trip to Disneyland, in order to take advantage of the subsidy. So higher car sales were balanced in part by lower sales in other parts of the economy.

- People who might otherwise have saved or paid down debt opted to purchase a car in order to take advantage of the subsidy.

Sales resulting from explanations 1 and 2 were simply a direct wealth transfer from future taxpayers to car buyers. There wasn’t any real impact on the number of cars sold, just the timing, so the car companies aren’t really better off. Any stimulative effect on economy would be the result of car buyers choosing to spend rather than save their subsidy windfall.

By contrast, sales resulting from explanation 3 were rather more insidious. In addition, to the wealth transfer from future taxpayers to car buyers these sales also include a wealth transfer from non-car companies to their automotive brethren. In other words, politically favored companies got some increased sales at the expense of those with less political pull.

Overall, these sales don’t represent any increase in aggregate demand. Again, any stimulative effect on economy would be the result of car buyers choosing to spend rather than save their subsidy windfall.

The subset of sales driven by explanation 4 was the most economically useful. Additional cars sold without an offsetting loss of sales in other parts of the economy actually represent an increase in aggregate demand.

So the utility of the program as a Keynesian stimulus depends on the proportion of sales driven by explanation 4 and the extent to which the windfalls enjoyed by car buyers driven by explanations 1, 2 and 3 were spent rather than saved. It is possible, even likely, that the effective stimulus was substantially less than the $3 billion plus the program cost.

Taking a broader view, this program suffers from the same problem that dogs most stimulus initiatives. A small fraction of the economy will experience direct benefits. The remainder of the economy will simply see future costs in the form of higher taxes, interest rates and inflation, and a more politicized economy. For this reason, stimulus efforts that aren’t linked to future productivity improvements are, at best, a questionable idea.

In the high profile lobbying contest to win hosting rights to the 2016 Olympics Brazil’s President Luiz Inacio Lula da Silva has completely shellacked President Obama.

In the grand scheme of things the location of the 2016 Olympics isn’t of great importance. In fact, Chicago is probably better off for having lost. However, Obama’s involvement in Chicago’s bid displays in microcosm one of the key problems with the Obama presidency.

Having stood aloof from the selection process, the president swooped in at the last minute, made a pretty speech and expected to swing the vote.

By contrast, the rather more effective President Lula da Silva was far more engaged. He apparently understood that the result would be decided well before the TV cameras were turned on. Lula was so confident he had the votes that he supposedly pressed the Obamas to go to Copenhagen.

President Obama’s approach to the Olympic selection process mirrors his approach to the far more important issues being decided on Capitol Hill. Stand aloof from the messy politics and trust that golden voice to swing the necessary votes.

It appears that we have an applause line President. He looks great on TV and gives a great speech. These are fine qualities in a politician, but fall well short of what is require to make an effective leader. When it comes to shaping legislation and winning diplomatic fights he is doing about as well as you would expect for a guy with a whole half term of Senate experience.

From the Stand-up Economist:

If I had to pick an animal to describe the US economy right now I’d have to go with the hamster. But like a really tired hamster that has been running around its cage for like seven years. Right now it’s exhausted.

As a micro-economist I would say that the hamster needs some rest. Macro-economists, of course, look at the hamster and think that it needs some methamphetamines.

Now, I’m sure that they are right. Over the past month I’ve learned that the three most terrifying words in the English language are, “macro-economists agree that”.

I’m sure they are right about the hamster needing methamphetamines. But all I’m saying is that in two years that is going to be one ugly hamster.

Bill Clinton apparently believes that the “vast right-wing conspiracy” that undermined his presidency (Did Republicans smuggle buxom interns into the White house?) is diminished but not dead.

This vast right-wing conspiracy theory is just as dopey as the vast left-wing conspiracy theory that remains very popular on Fox News.

Isn’t it about time that America’s leaders came to to accept that some people will inevitably oppose their policies, dislike them personally, or find some other reason to make their lives as difficult as possible? It is a mystery to me why American politicians feel that they ought to be handled with kid gloves.

In the UK (also New Zealand, Australia, Canada and India) the Prime Minister is required to front up in parliament on a weekly basis and answer the best verbal assault that the opposition parties can muster. This forces the leaders of these countries to develop nice thick skins. It also removes any illusions they might have about entitlement to deferential treatment.

By contrast, American leaders, who generally avoid unscripted situations whenever possible, are complete wusses. Perhaps weekly ‘President’s Questions’ in Congress might toughen up the denizens of the White House so they don’t feel the need to cry like little girls when people don’t treat them nice.

Former Secretary of Labor and commentator extraordinaire, Robert Reich, has been raised an interesting question:

So how can the Dow Jones Industrial Average be flirting with 10,000 when consumers, who make up 70 percent of the economy, have had to cut way back on buying because they have no money? Jobs continue to disappear. One out of six Americans is either unemployed or underemployed. Homes can no longer function as piggy banks because they’re worth almost a third less than they were two years ago. And for the first time in more than a decade, Americans are now having to pay down their debts and start to save.

Even more curious, how can the Dow be so far up when every business and Wall Street executive I come across tells me government is crushing the economy with its huge deficits, and its supposed “takeover” of health care, autos, housing, energy, and finance? Their anguished cries of “socialism” are almost drowning out all their cheering over the surging Dow.

So, if all this Keynesian policy is so bad for the economy, why are investors so bullish? Mr Reich’s argument is the Keynesian stimulus is working for corporate America (if not for ordinary Americans).

However, there are several plausible (non-Keynesian) explanations:

- The bull run is really just a bounce back from the panic selling that occurred earlier in the year. Even if the economic outlook remains bleak, it’s much less bleak than it was. Relief that the world isn’t going to end isn’t inconsistent with concern about the future.

- US corporations are poised to benefit from a rebound in the world economy and a sinking dollar. There is nothing inconsistent about being bearish on the US economy and bullish on multi-nationals.

- The market may think that many of the Obama administration’s more ambitious proposals aren’t actually going to pass. Cap-and-trade is already on the rocks, getting health reform through the Senate is far from certain and the volume of concern about the deficit increases every day. If investors think the Keynesian surge is already abating they may be more comfortable buying stocks.

- It is clear that the government will find a reason to bailout just about any large corporation that runs into trouble. This policy of socializing losses is likely to promote corporate risk taking on a fairly epic scale. More risk means higher profit potential, which in turn means higher stock prices (arguably this is a form of state subsidy, but has little to do with boosting aggregate demand).